Here’s what you need to know…

- There’s no excuse for your business to be weak after years of trying to improve profits. Fix it by rethinking your attachment to out of date procedures.

- If you’ve been trying to drop the same volume of dead stock since the day you started in the business, figure it out – you’re doing it wrong. “The same procedures we’ve always used” doesn’t work.

- If your profits are skinnier than you’d like them to be, your ideas about stock management and control are probably 10 years old and your definition of “good stock” and how to treat it needs an adjustment.

“Fat” in your business means carrying an unhealthy level of unprofitable stock that is smothering your profits. “Weak” means there’s stock issues that are preventing the business from becoming strong and powerful. And “Skinny” can look and feel healthy but when the burly competition turns up on the beach and kicks sand in your face, your spaghetti arms and pigeon chest just won’t cut it.

If you reckon your stock works as hard to make a profit as you do, but the profits are still lower than you think they should be, the business is either fat, weak or skinny; it’s time to change your approach.

Here are five things you’re probably doing that are exactly why you’re not seeing the results you want.

- No one knows which products are making the business fat and unprofitable. Ask your staff which products they think are costing the business the most money and chances are the answer is going to be way off base. If no one knows what’s making them fat, weak or unprofitable and why it’s happening, then it can’t be fixed. But let’s be clear, zero “fat” is not a target either, it’s a matter of knowing what “fat” is ok in your business and having strategies in place that control it without hurting your bottom line too much. Some fat is necessary – call it “good fat”. Like the odd phillips head screwdriver you’ve got sitting on the shelf that never sells. You have to keep it in stock otherwise your screwdriver range looks incomplete and if it looks incomplete, the perception is that you don’t have a full range. Customers don’t like that and they’ll go elsewhere, and stay there! So, a little fat here and there is necessary and good for business.

- You’re not fixing the things that KEEP you fat, weak or skinny. It’s common to see businesses struggling continuously to get rid of bad stock yet they keep using the same processes that created the bad stock in the first place. Eating cream donuts while running on a treadmill might be fun, but if you keep it up every day you’re going to wake up in hospital with one of those machines that goes “BING” next the bed. Stop doing those things that hurt you!

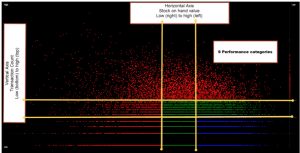

- No one knows how to categorise their stock in ways that can be used to drive profits up. Ok, many computer systems allow you to set up categories like ‘A’, ‘B’, ‘C’. They’re basic rankings but they don’t give you too much of an insight into each products’ contribution to the profit and overall performance. You need a detailed and insightful analysis that explodes the data and gives you a powerful look into what’s driving your profit up – and down! A double ABC analysis like the ones shown, smash any normal analysis out of the park. This is where the real money is made or lost.

- Staff have no clear information for managing the good performers or how to improve the capacity and profit of poor performers. When everyone knows what stock performs well and why, then it’s easier to get that stock working hard for you. That’s what you want; you want to have your investment working harder than you are, to make you a decent profit.

- The whole process isn’t wrapped up in an effective system that deals with all this. They key word here is “effective”. Lots of people use a purchasing system of some sort. I’m not talking about the computer system either, I’m talking about the whole purchasing process. Sometimes it’s a system in their head, sometimes it’s whatever the staff have come up with to make things easier, sometimes it’s whatever the suppliers have put in place…. Not too often is it simple and effective and used every day, without fail, right across the business.

Click to enlarge

Quick Summary

- Decide that 2016 is going to be the year that your stock works harder and earns more profit dollars for you.

- Get your full stock file analysed and categorised into performance categories. You should accept nothing less than a double ABC analysis using the criteria of transaction count and stock on hand or a similar method.

- Ensure those products in the ‘AA’ category (for example) are never out of stock and your staff know what the products are – even if your computer system can’t handle this method of ranking the stock, have a list handy for them to refer to.

- Look for opportunities within other categories where products can be moved into higher performing areas. For instance, products in ‘BA’ or ‘BB’ might be ranked lower because they’ve been out of stock on a regular basis and if we changed how we order it, or we speak to the supplier, perhaps we can improve the transaction count and therefore the profit dollars.

- Devise and implement (and use every day!) a purchasing budget that is based on your expected sales and profits for the current and next month.

- Split the purchasing dollars amongst each department. Make staff aware of the purchasing guidelines and monitor the progress regularly throughout the month, with feedback to the staff on how they’re going.

Do these things and you’ll drop the fat and when that bully comes to town and wants to kick sand in your face, flex those new profit muscles.